IRD Audit Notice?

Don't Panic! We'll Help You Through It.

Talk to a former IRD investigator today:

- Minimise penalties

- Save time

- Protect your reputation.

IRD Tax Audit Support

At Smart Tax Solutions Limited, we understand that being selected for an Inland Revenue (IRD) audit or investigation is stressful. Whether you’re an individual or a business, the process can feel intimidating, intrusive, and confusing. You might wonder what exactly IRD wants, what your rights are, or what you need to provide.

Our team includes former IRD audit investigators, so we know how IRD operates from the inside. We’ve helped numerous clients through audits, reviews, and disputes of all kinds. We make sure you’re well-prepared, protected, and confident throughout the process.

What an IRD Audit or Investigation Entails

- IRD audits (or investigations) are checks of your financial affairs to confirm that you’ve met all your tax obligations — that you’ve reported income correctly, claimed allowable deductions, paid GST, employer obligations, etc. IRD Link

- Audits can be triggered by risk-selection methods: unusual patterns, data matching, discrepancies in returns vs. bank statements, high expenses relative to income, sudden changes in business profits, property transactions, or noncompliance in industries known to have issues. More...

- IRD uses computer-assisted audit techniques, intelligence, and data sources (including payment service provider data, property data, trusts, Companies Office info, etc.) to flag issues.

- Not all IRD contact is an audit. Sometimes they are gathering information or doing a risk review. But once you are notified that an audit or investigation has begun, formal obligations kick in.

How We Can Help

When your affairs are being reviewed or audited, our services cover everything you may need — from preparing to defending.

Review

We review your past financial records, returns, and supporting documents to identify areas that might be questioned by IRD before they ask.

Assemble and Organise

We help you assemble and organise all the documentation required — income, expenses, bank statements, GST returns, payroll records, property transactions, etc. so responses to IRD are accurate and timely.

Liaise with IRD

We liaise directly with IRD on your behalf — dealing with letters, information requests, setting deadlines, clarifying scope. You don’t need to battle through complicated IRD correspondence alone.

Represent You

We represent you in meetings or interviews with IRD. Our ex-IRD investigator members understand what questions are likely to come up and how to respond in a way that protects your rights.

Negotiate Practical Solutions

If IRD identifies discrepancies, we help negotiate practical solutions — working on adjustments, managing penalties and interest, considering voluntary disclosures if appropriate, to reduce cost and risks.

Why Choose Smart Tax Solutions?

- Experience: we’ve successfully managed many audits and investigations including by IRD’s most compliance-focused teams.

- Insiders’ insight: with our ex-IRD investigators, we understand audit methodologies, risk signals, what IRD expects to see in documentation, and how to avoid common pitfalls.

- Tailored approach: every audit is different. We plan our support based on your type of business, your risk profile, and your personal or company structure.

- Reputation & discretion: we work confidentially, ethically, and aim always to protect your reputation while reducing disruption to your business.

What You Should Do Early

- Don’t wait until IRD contacts you: if you think there might be issues in your past returns or record keeping, it’s better to engage help early.

- Keep clean, well-organised records: all income statements, expense invoices, bank/credit card reconciliations, contracts, trust distributions etc. up to date—this makes the whole process far less painful.

- Be ready for information requests: timeframes matter in audits; delays can increase penalties or interest.

- Consider voluntary disclosure: if you discover an error —Tax law provides incentives for full disclosure before or early in an audit

Recent Trends & Focus Areas

To give you context, here are some areas IRD is increasingly focusing on — things you’ll want to make sure are in order:

- Property transactions: rental income, interest deductibility, bright-line tests, frequent trading in property.

- Hidden economy / cash-intensive sectors (e.g. hospitality, construction) where under-reporting of income or misuse of sales suppression tools is more common.

- Trusts, company structures, and whether income is being retained in companies or distributed correctly.

- Non-compliance with GST, payroll, employer obligations, electronic filing, record-keeping standards.

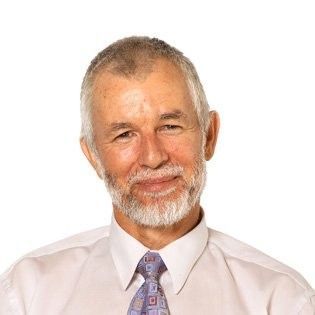

TALK TO A FORMER IRD INVESTIGATOR

Gary O’Neill has had a long involvement with GST. He was working in the IRD in 1985 when the GST was first proposed and since April of that year has worked almost exclusively on GST related matters.

He has extensive experience in relation to all aspects of GST, including:

- Land sales and purchases

- Zero rating; exports of goods, or services

- All aspects of insurance

- GST issues relating to finance

- IRD disputes / IRD audits

- Local government issues; rates, grants, "fines", licence fees

- GST in relation to vouchers, gift cards, sale of "PINs" both domestically and cross border

Testimonials

When I was hit with a tax audit and had to get myself an accountant, I very quickly found out that almost all accountants seem to work for the IRD. None were interested in helping me present my case or fight for me. Introductory meetings started with accountants discussing my payment plans to them and the IRD. It was assumed I was guilty already. It took me days of researching the internet and endless phone calls and referrals to find Smart Tax Solutions. I just wanted someone who would go to battle with me and who knew more than other accountants I met. I wanted an accountant with teeth. That's what I got. I feel I have been dealt with reasonably and fairly. I highly recommend them.

Morag McDee